Background

In 2016, the Fundraising Regulator was set up as a voluntary regulator to help make sure charitable fundraising is respectful, open, honest and accountable to the public.

The creation of a new regulator was recommended in September 2015 by a cross-party review in response to several high-profile cases where fundraising practices had caused significant public concern. The Government accepted all the recommendations of the review.

We have not changed what we ask charities to pay through the levy and registration since September 2016.

Since the regulator was founded, we have worked to promote public trust in the sector by:

- Updating and promoting standards through the Code of Fundraising Practice and associated guidance. We significantly updated the code in 2018/19 and have recently consulted the charitable sector, the public, and fundraising stakeholders and legislators on a full review of the code.

- Investigating complaints from the public about fundraising practices. We usually get over a thousand complaints a year. If we find a charity has not adhered to our code, we recommend best practice guidance and take proportionate remedial action.

- Publishing our Annual Complaints Reports to identify areas of concern across the sector. Recently these have included door-to-door fundraising complaints, the treatment of vulnerable people and the need to present information in an open and honest way online.

- Operating the Fundraising Preference Service so that members of the public, especially the vulnerable, are empowered to manage their direct marketing communication from charities. So far over 55,000 suppressions have been made by the public for over 2600 different charities.

- Providing advice to charities and the public on fundraising matters. Last year 800 pieces of free tailored advice were given to charities, the public and stakeholders. We also attend many sector events every year to encourage best practice in fundraising and support initiatives such as safer giving.

Our research indicates that trust in this voluntary system of regulation continues to grow. The proportion of charities who paid the levy has increased from 93 to 98% in the last four years. Our last annual report also found a 24% rise in registrations over the previous year from smaller charities (those who spend less than £100,000 on fundraising) and our research shows that the public are more prepared to donate to charities that use the Fundraising badge.

You can find more detailed information on our history, work, governance and how we are funded here.

Current funding model

We charge charities an annual levy according to the amount they spend on fundraising.

This was recommended in the 2015 cross-party review. After consulting the sector when we were established in 2016, we decided this system was the fairest as it meant the biggest fundraising spenders paid the largest fees.

Apart from a small change in 2019 to make the banding fairer to smaller charities, our funding system and rates have remained unchanged over the eight years since we were created.

You can read the original Levy Review 2016 for more information on how they were set in the first place. And find out more about the changes we made to introduce new bands here.

Proposed funding model

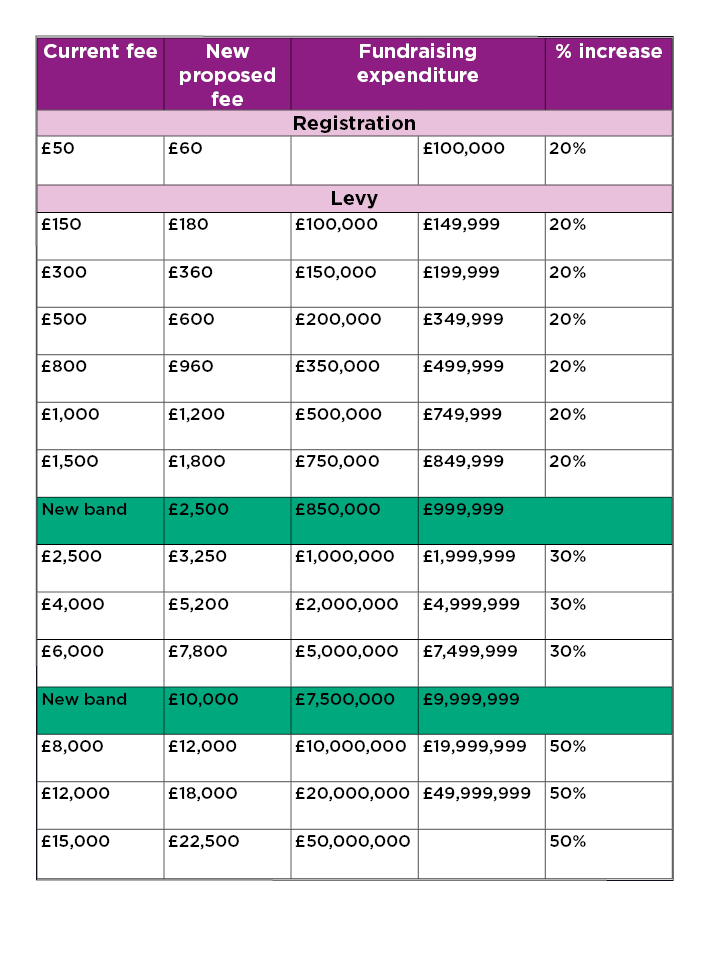

Each year there are around 2,000 charities covered by the levy. The levy will increase for everyone, but the more you as a charity spend on fundraising, the higher that percentage increase will be. Conversely, the less you spend on fundraising, the lower it will be.

So, for example a charity spending over £50 million on fundraising will be asked to pay £22,500, one spending up to £1.1million will pay £3,250, and one spending up to £350,000 will pay £600. Those in the lowest levy band will see their fee increase from £150 to £180. This means the highest-spending charities’ levy payment will rise by 50%, medium-spending charities’ levy payment by 30%, and lower-spending charities’ (which make up the majority of those registered with us) by 20%.

If we had raised rates in line with the Consumer Price Index (CPI) since 2016 the levy would currently be 25% higher for everyone.

Under this system, the top 327 registered charities will pay a greater proportion of the entire levy. We believe this is the fairest way to spread the cost.

We have also introduced two extra bands so that the rise in levy payments is more gradual as charities move up the payment scale.

Overall, the levy will still represent a fraction of a percentage of a charity’s total fundraising expenditure. In addition, it represents an even smaller percentage of a charity’s income from donations (donated income for the top 10 largest levy paying charities in 2021/22 totalled £2.376 billion and ranged from £27 million to £426 million).

From September 2025, we intend to increase the levy by CPI each year so that future rises are more gradual, and we will let levy payers know what these will be in advance.

The levy will also increase for commercial fundraisers and exempt charities (for example, universities in England).

Small charity registration

We propose to increase the administration fee for small charity registration from £50 to £60 to reflect a rise in our processing costs since 2016. We will review the fee from time to time in the future, but it will not be subject to annual CPI increases to make it simple to administer.

Why we need to increase the levy

Proactive regulation

In our Strategic Plan 2022-2027 we reaffirmed our commitment to being a pro-active regulator. With this in mind, we are currently reviewing the Code of Fundraising Practice to take into account, among other things, the effect of new developments on the sector and fundraising in particular. We want to make sure we have adequate funding to continue to advise, support and regulate the sector during these changing times (for example through market inquiries) and we recognise that at the moment fundraising is much harder than it has been for a while.

Our Strategic Plan also sees us engaging more actively with the charities we regulate through increased capacity to learn from charity fundraising experience and share our own learning. For example, by undertaking wider inquiries or carrying out research into aspects of fundraising which will be of benefit to charities and those they work with.

We have already started this work with the market inquiry we announced in October 2023 into how charities use contracts and sub-contracts to deliver their fundraising strategies and some commissioned research into how the public views fundraising. We will publish the results in 2024.

Caseload

As public awareness of the regulator has grown, so has our casework. Our 2020/21 annual report found that our caseload had increased by 26% over the previous two years. In addition, as fundraising methods change and more fundraising happens online, our small team is dealing with an increasing number of complex cases and sensitive issues of public concern. We want to make sure we have enough resources to support this work.

Online fundraising

There has been a significant rise in digital fundraising since the Fundraising Regulator was established in 2016. The ongoing growth of fundraising platforms, contactless giving and social media fundraising requires new regulatory responses and increased levels of partnership working with the sector to ensure public protection and accountability in this rapidly evolving landscape.

Economic climate

As you will know, the economic situation continues to be challenging. As with the rest of the country over the last year, our running costs have been affected by unexpected inflation of over 10%.

Alternative ways of meeting our costs

As part of our commitment to providing value for money, we considered a variety of ways of supporting our work that didn’t involve increasing the levy.

These included:

Use of reserves

For the current financial year, we are running at a deficit using funds from our reserves. However, this is only sustainable for a maximum of two years before our reserves fall below a safe, minimum level of around six months of running costs. It is therefore not a long-term solution.

We keep a reserve fund of around £1.5million to cover around six months of operating costs. The balance of our current reserves (around £500k) is held in order to support legal costs in case any of our decisions are challenged in court. As a voluntary regulator we are limited in the legal insurance cover we can rely on.

Making savings

In 2021/22, we made savings by cutting the cost of the Fundraising Preference Service from £260,000 to £148,000 a year, a percentage reduction of 42.5%. However, we believe the scope for us to make further spending reductions through efficiency savings is limited. We have a small team of around 30 people and benchmark pay rates against a range of other bodies in the regulatory, public and charity sectors. This is carried out by independent specialists. In the last few years, we have moved to a more flexible way of working with fewer desks in an office to reduce the cost of accommodation. All this with a view to making sure we provide good value for money.

Relying on growth of fundraising expenditure

While we think that inflation is likely to increase fundraising expenditure and therefore levy payments over the next few financial years, we consider that these increases will be slow. Unfortunately, the growth of fundraising expenditure is unlikely to provide the additional funding we need to enable us to remain an effective regulator.

Next steps

We are proposing an increase to the levy for the first time in the eight years since we were created. This increase will help us to continue providing the robust self-regulation of the sector that promotes public trust.

Our levy review closed on 9 February 2024. Our board will now reflect on the review and we will publish a summary of responses. After that, the new levy rates will be confirmed in April 2024 and come into effect in September 2024 to give charities plenty of time to prepare.