The Charities (Protection and Social Investment) Act 2016 (‘The Act’), introduced new legal requirements for charities to demonstrate their commitment to protecting donors and the public, including vulnerable people, from poor fundraising practices. The Act reinforces responsibility and accountability for fundraising and strengthens the Government’s reserve powers to regulate fundraising.

Under the Act, charities are required to provide a statement (or series of statements) on fundraising in their annual report, which is submitted to the Charity Commission for England and Wales. The statement(s) must cover key aspects of their fundraising work including the approach taken, regulation, complaint numbers and vulnerable people.

The following analysis evaluates how charities are adapting to the new reporting requirements of the Act. By looking at a sample of the first annual reports, we have assessed to what extent charities are compliant with the Act.

This included:

- whether the charity was compliant with the Act in including statements on everything the law requires; and

- where statements were included, what level of detail was provided in each case.

Summary of findings

- The majority of reports reviewed were not fully compliant with the Act, with only 40% including an adequate fundraising statement. Statements did not sufficiently cover all requirements of the Act, often failing to comply on one or two points.

- Registration with the Fundraising Regulator is highlighted in most reports but more needs to be done by charities to demonstrate how they use the standards in the Fundraising Regulator’s Code of Fundraising Practice to guide their work.

- More detail about fundraising carried out on behalf of the charity needs to be included in statements, including how this work is supervised and managed.

- 40% of statements did not include the number of complaints received which is a requirement of the Act.

- Reports often lack detail of how vulnerable people are protected in the charity’s fundraising work.

- Charities which spend more on fundraising have adapted to the new requirements better, providing more detailed statements with all requirements covered.

The analysis

1. Background – the Act

The Charities (Protection and Social Investment) Act 2016 requires registered charities which have their accounts audited (where gross income is over £1 million), to include extra information about fundraising in their trustees’ annual report.

The 2016 Act amends the Charities Act 2011 by adding a new Section 162A which states:

a. 162A Annual reports: fund-raising standards information

(1) If section 144(2) applies to a financial year of a charity, the annual report in respect of that year must include a statement of each of the following for that year -

(a) the approach taken by the charity to activities by the charity or by any person on behalf of the charity for the purpose of fund-raising, and in particular whether a professional fund-raiser or commercial participator carried on any of those activities;

(b) whether the charity or any person acting on behalf of the charity was subject to an undertaking to be bound by any voluntary scheme for regulating fund-raising, or any voluntary standard of fund-raising, in respect of activities on behalf of the charity, and, if so, what scheme or standard;

(c) any failure to comply with a scheme or standard mentioned under paragraph (b);

(d) whether the charity monitored activities carried on by any person on behalf of the charity for the purpose of fund-raising, and, if so, how it did so;

(e) the number of complaints received by the charity or a person acting on its behalf about activities by the charity or by a person on behalf of the charity for the purpose of fund-raising;

(f) what the charity has done to protect vulnerable people and other members of the public from behaviour within subsection (2) in the course of, or in connection with, such activities.

The full legislation can be found at: https://www.legislation.gov.uk/ukpga/2016/4/section/13.

The Act came into force for charities with accounts with a year end from November 2017 onwards.

2. Method

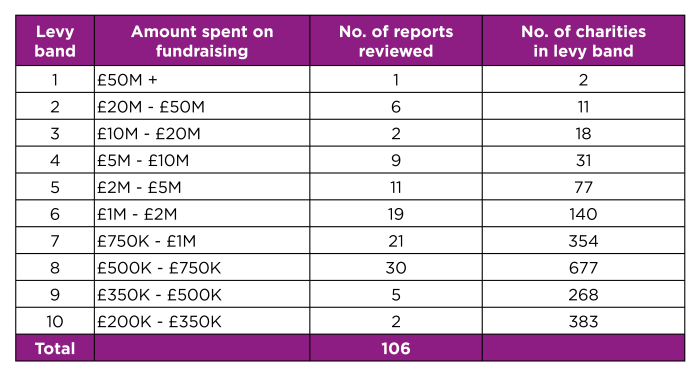

In April 2019, the Fundraising Regulator reviewed 106 annual accounts filed with the Charity Commission. The sample was selected randomly from charities required to comply with the Act which spend more than £100,000 on fundraising per annum and represent a cross section of different size charities in terms of their fundraising spend. These are charities which are in the Fundraising Regulator’s levy.

We reviewed each annual report looking for a fundraising statement which covered the requirements of the Act. We also looked at other relevant sections of the report which summarised fundraising campaigns or looked at compliance or safeguarding to ensure that information wasn’t missed. In the absence of a discrete statement on fundraising, we were sometimes able to identify partial compliance with the Act in this way. We then scored each report for its compliance, making notes of the strengths and weaknesses of the particular report.

3. Sample

We reviewed the annual reports of 106 charities. This is 6% of those paying the levy (1,755 charities in April 2019 at the time of the survey). These were selected randomly from our internal batches (grouping we use to manage the levy) and as a result the following breakdown was achieved.

Table showing analysis sample sizes

4. Scoring

We developed a scoring system which looked at compliance and the depth of reporting. The scoring system and number of charities achieving those scores are set out below.

Compliant with the Charities Act 2016 requirements on fundraising statement

5. Excellent: comprehensive report (19 reports)

- All requirements are covered in detail in a discrete section

- A clear overview of fundraising undertaken and by whom is provided within the statement

- Detail of how they work with the regulatory framework and make connections to Fundraising Regulator and Code of Fundraising Practice

- How they actively monitor and manage those fundraising on their behalf

- Actual number of complaints

- How they protect vulnerable people and what they have done

4. Very good: fully meets reporting requirements (16 reports)

- All requirements are covered with some in more detail

- Must have an overview of the fundraising approach taken – though this may be in part, in the main body of report (as opposed to statement)

- Recognition of regulatory framework and tools for this (the code, Fundraising Preference Service)

- They state they are monitoring certain activities and provide some examples

3. Satisfactory: sufficient information to meet reporting requirements (eight reports)

- All requirements are covered in some way

- Some detail is lacking – for example: the detail of who carried out the fundraising or how they monitor fundraising activity carried out on their behalf

Not compliant with the Act

2. Poor compliance: too little information (35 reports)

- Some elements are covered but some are missing. For example: number of complaints or how vulnerable people are protected.

- Could see very good or excellent statements that become non-compliant because they miss one key element

- There is partial information for most elements

1. Non-compliant: no reporting information (28 reports)

- No statement exists

- Some fundraising information is contained in the report but it is not set out in a way which allows the reader to understand how it is managed

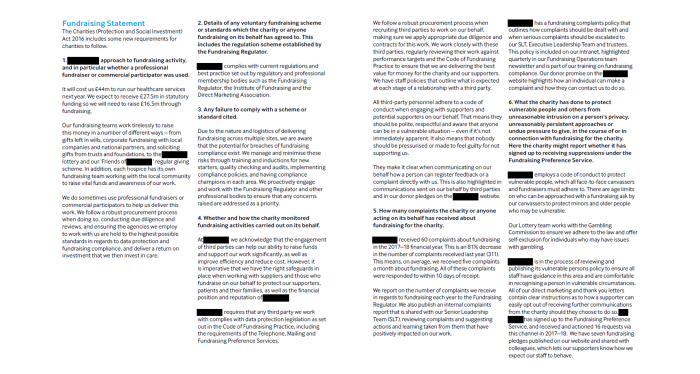

An example of a compliant statement

In our assessment of the report, this statement scored a 5 and covered all aspects of the requirements.

An example of a compliant statement

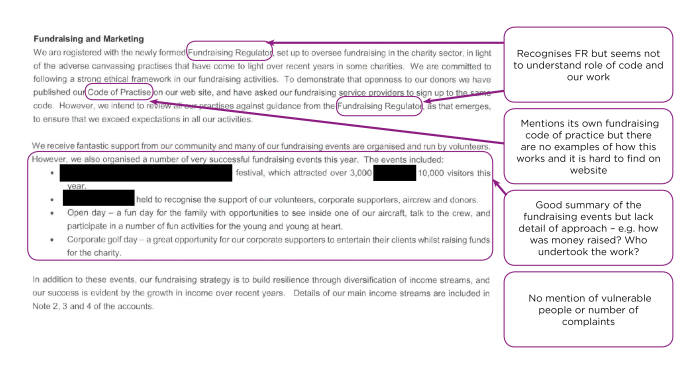

An example of a partially compliant statement

In our assessment of the report, the following statement scored a 2.

An example of a partially compliant statement

5. Considerations

It is important to note the context for annual reports and the new requirement on charities. This is the first year that charities have had to report on fundraising in this way, so it is to some extent understandable that there are adjustments still to be made.

Corporate service and finance teams who are largely responsible for the development of the annual reports should have become aware of the requirements of the Act through professional development and membership bodies, but it’s possible they may not have. Auditors may have reminded charities to include this section, though there is no onus on them to do so because it is part of the trustees’ annual report rather than the accounts. Hence, there is a risk that some teams may be unaware of the requirements in full.

Ultimately it is the responsibility of trustees to ensure compliance with the Act. Trustees need to be aware of the requirements and understand why they are important, so they can perform their role effectively.

6. Key findings

Despite the vast majority of charities including a statement of some type, only 40% (41 out of 106) of annual reports reviewed were fully compliant with the Act (scoring 3 or more in our assessment). To be compliant with the Act, the statement or other relevant sections in the report must cover all requirements in a clear manner or confirm that the charity does not undertake any public fundraising.

A report would be non-compliant if it was missing one or more of the key requirements. Some statements were not compliant because the charity did not adequately cover all aspects.

Some specific ways that reports were not compliant with the Act are as follows:

- Lack of detail on what kind of fundraising is carried out and by whom;

- No recognition of whether the charity was bound by a voluntary scheme for regulating fundraising, such as that operated by the Fundraising Regulator, or a voluntary standard of fundraising, such as the Code of Fundraising Practice;

- No detail of how they monitor fundraising carried out on their behalf;

- A lack of detail on the number of complaints they received; and/or

- No mention of the approach taken regarding vulnerable people.

We have identified some specific findings and learning points for charities:

a. Make sure all requirements are sufficiently covered

Reports often demonstrated a great understanding of the charity’s fundraising work, offering a very detailed overview of how they manage and monitor work undertaken. But they were judged to be non-compliant as they missed a key requirement and this undermined an otherwise excellent statement.

Many short statements missed the requirements without giving detail of how, for example, they use the regulatory framework to support their work. We also found examples of good reports and comprehensive statements that could still be non-compliant by missing key requirements such as how they monitored the work of third parties.

b. Create a distinct statement on fundraising to ensure compliance

In the reports we reviewed, this was usually a distinct part of the report and was easily identifiable. The Act does not require this approach, only that all requirements are covered.

The majority of charities provided a statement in their annual report. But the length and standard of information varied dramatically. 22% (23 charities) did not include a discrete statement on fundraising and instead had small amounts of information spread across their annual report.

In some cases, we found information that the Act requires in other parts of the report. For example, some charities had a wider compliance statement which covered GDPR and other regulations which featured fundraising. Some charities explained in more detail about their fundraising work and who carried it out in the sections which summarised activity taking place that year.

The review found that a distinct statement on fundraising allows charities to demonstrate compliance with the Act more easily. It also offers the charity a way to communicate clearly on how it manages fundraising and complaints, which aids transparency and can give confidence to donors and the public.

c. Ensure a clear overview of approach to fundraising

69% (73 out of 106) of charities gave an overview of fundraising activities which was either satisfactory or better on this specific requirement. Many reports cover what fundraising campaigns were undertaken but some lacked detail of how the fundraising is carried out and by whom. Some reports would include many pages on the success or impact of particular fundraising campaigns, often within the main text section summarising the charity’s work. However, the report as a whole and the fundraising statement section itself could lack the detail on how the campaigns were run, who delivered the work and how the work was managed or monitored.

d. Recognition of regulation is important

Section 162A (1) (b) of the 2011 Act refers to the charity being bound by any voluntary scheme for regulating fundraising, or any voluntary standard of fundraising, and to state which one. It does not require the charity necessarily to recognise the Fundraising Regulator or link to the Code of Fundraising Practice specifically, despite no other universal standards or system of regulation being in existence. Charities can technically create and adopt their own voluntary standards under the legislation.

However, by recognising the Fundraising Regulator and adhering to the code, charities meet this requirement in the Act. By committing to meeting the standards in the Code of Fundraising Practice, charities remove the need to create their own standards.

In 69% of the reports (73 reports out of 106) the Fundraising Regulator was recognised. However, the statements did not always refer to us correctly and showed a lack of understanding of our regulatory work. The statements rarely referred to the standards we set. The reports sometimes incorrectly referred to being a ‘member’ of instead of a ‘registrant of’ the Fundraising Regulator, or even to being a member of the previous regulator, the Fundraising Standards Board.

Section 162A (1) (c) of the 2011 Act requires that charities state any non-compliance with regulatory standards. This could be demonstrated in two ways: a proactive statement of actual or potential non-compliance (of which we have seen little evidence) or inclusion of complaints received by the Fundraising Regulator.

Where relevant, we checked that the reports included details of non-compliance or where we had upheld a complaint about their fundraising work. We found that of the 106, we had investigated and upheld complaints relating to five charities. Of these, three charities included working with us on our investigations in their statement and two omitted this. We believe that a statement about complaints we have investigated should be included to be compliant with the Act.

e. Management and monitoring of fundraising carried out by others

Some charities, mostly larger charities, detailed how they managed fundraising being undertaken on their behalf, whether that is by professional or community fundraisers. However 45% (48 out of 106 reports) had no, or an insufficient, description of how they monitored those fundraising on their behalf.

For those reports that did provide monitoring information of third-party professional fundraisers, the following activity was included: using contracts to ensure third-party fundraisers met standards; using methods such as mystery shopping and phone call listening to ensure quality; or training the third-party teams on the charity’s preferred approaches.

Some reports provided detail of how the charity supported branches or community fundraisers such as through training and guidance. However, others did not include the detail of managing and supporting fundraisers in their report even when it was evident that the charity used these approaches, meaning their report was not compliant.

Poor reporting on how fundraisers were managed was often compounded by an inadequate description of who carries out the fundraising activity. Therefore, it was difficult to determine if any third-party organisations, community fundraisers or corporate partners were involved and subsequently to assess compliance with the Act.

f. Complaints management is an important part of fundraising work

Reports should, as minimum requirement, set out the number of complaints about fundraising the charity has received. A small number of charities went into more detail and offered insight into the nature of the complaints and how they were dealt with which was useful.

Notably, 40% (42 out of 106) of reports did not offer a specific number of complaints received. Some reports used wording similar to “small number of complaints” which is not adequate and others did not offer any information on fundraising complaints at all.

g. Lack of consideration towards vulnerable people and fundraising

A requirement of the Act is to consider vulnerable people, however, we found this was inadequately covered in the reports reviewed. 54% (59 out of 106) did not cover this to a satisfactory level.

At a basic level, some reports pointed to the charity having a relevant policy for vulnerable people, from which it might be possible to derive ways to protect people who give to the charity.

Those that did give more details explained what the charity was doing to protect vulnerable people, such as training staff and putting in place a specific vulnerable supporter policy and guidelines for fundraising teams and third parties.

The large majority of the reports did not describe, in any way, how the charity ensures vulnerable people are considered in relation to fundraising. Although some state they do protect vulnerable people, they do not sufficiently describe what they do put this into action. This does not give confidence and is inadequate in light of why the new legal requirements were introduced.

h. Larger charities have adapted to the changes better

Charities which spend larger amounts on fundraising appear to have adapted better to the new requirements. We understand that these charities may have more developed governance functions and resources that ensure they are up-to-date with reporting requirements. Although there are some exceptions, these charities have generally added comprehensive sections to their report which cover fundraising and the criteria of the Act.

Often the statements are comprehensive with detail for each of the criteria. Some have even used the criteria as headings within the statement. This demonstrates that they can clearly communicate their approach to fundraising and have systems in place to manage, monitor and record complaints.

There are also examples of good statements in those charities reviewed which spend less on fundraising. However, these statements are generally briefer and many are not compliant.

Conclusion

This review highlights that there is potentially a lack of compliance in the sector with regard to Section 13 of the Charities Act 2016 on fundraising. Though the majority of reports provide a fundraising statement only a small number of charities do so in a compliant way for the reasons set out in this analysis.

Although this is concerning, it should be set in the context that this is the first year of the requirements of the Act have come into force. More can be done to support understanding of the requirements of the Act and why providing a comprehensive fundraising statement is both important and helpful to the charity.

We intend to discuss the findings with the charity sector through infrastructure bodies and to work with charities to promote better practice in reporting. We will also share the report and its findings with the Charity Commission and the Department for Culture, Media and Sport.