Introduction

The Charities (Protection and Social Investment) Act 2016 (‘the Act’) requires charities in England and Wales with an income of over £1 million to provide statements on specific areas of their fundraising in their annual report, which is submitted to the Charity Commission for England and Wales (CCEW).

These statements cover key aspects of a charity’s fundraising activity including:

- The approach taken to fundraising

- Whether the charity is subject to any regulation

- How they monitor fundraisers

- The number of complaints received; and

- Steps taken to make sure vulnerable people are protected.

Including these statements in the annual report means that charities can demonstrate that they are reporting in line with legal requirements. It also encourages openness and transparency and helps to build public trust in their processes.

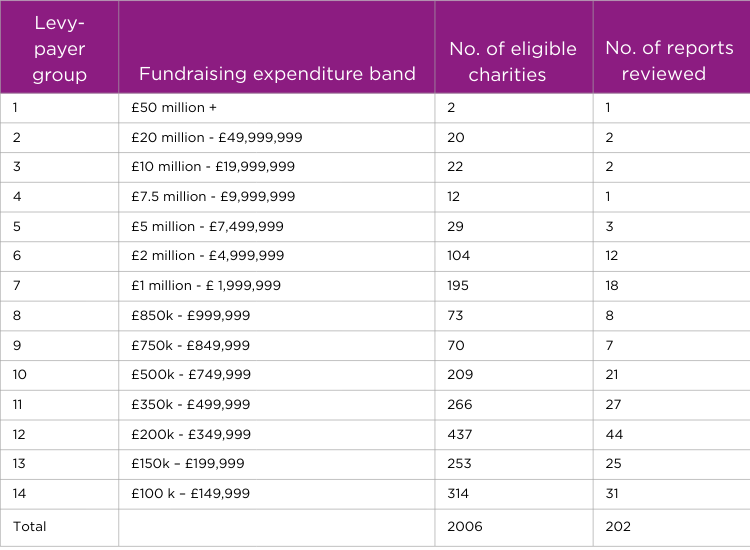

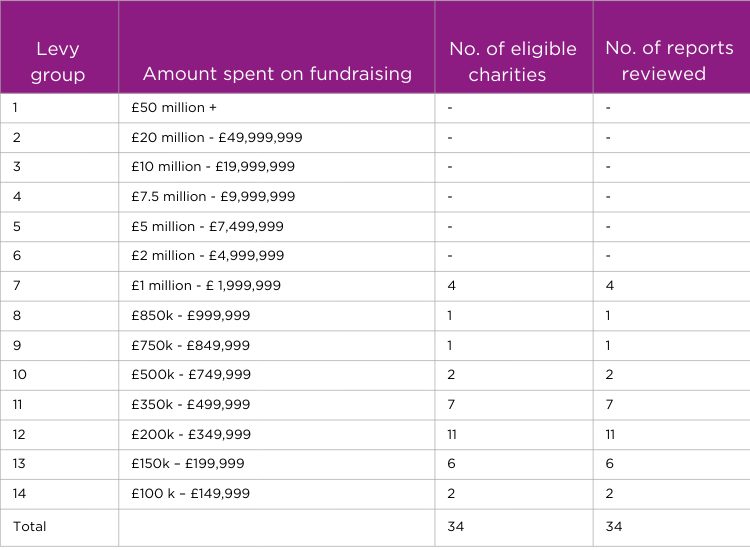

In June to October 2025, we reviewed the reports of a sample of 236 charities with an income over £1 million. Of these charities:

- 202 had paid the voluntary Fundraising Levy for 2024/25 as they had spent over £100,000 or more each year on their fundraising activities – we refer to these throughout as ‘levy-payers’.

- The remaining 34 either actively refused to pay the levy or did not respond to invoices to pay and follow-up reminders – we refer to these throughout as ‘levy-refusers’.

For more information, see the methodology

This review aims to provide a benchmark for the charity sector, highlight good practice, and identify areas for improvement in the reporting of fundraising activity. In this report, we have kept all data including the names of organisations, anonymous.

A note on the new Charities Statement of Recommended Practice (SORP)

On 31 October 2025, the new SORP was announced. It will apply to reporting periods starting from 1 January 2026, and the new audit thresholds come into effect from 30 September 2026. Future monitoring of compliance with The Act will focus only on charities with an income above the new £1.5 million threshold.

Overall key findings

This is the seventh year that charities have had to meet the Charities Act 2016 reporting requirements, and this is the fourth time we have conducted an analysis of reports during this period. We used the same scoring system as in 2022 for this report.

Improved compliance

Compliance among levy-paying charities in the sample was higher in most categories compared with 2022. The largest improvement was in reporting on the monitoring of fundraising activities carried out on behalf of the charity, which rose from 40% to 51%. There were also increases in reporting on fundraising approaches (89%), the number of fundraising complaints received (72%), and the steps taken to protect vulnerable people and other members of the public while fundraising (55%). The only area where compliance declined was in reporting on participation in voluntary regulations and schemes (74%).

The 2022 research identified two key areas for improvement: how charities monitor third-party fundraising and how they protect people in vulnerable circumstances. In this year’s sample, both areas showed improvement among levy-paying charities, with monitoring rising from 40% to 51% and safeguarding from 45% to 55%. For levy-refusers, monitoring declined substantially while safeguarding increased, though these findings should be interpreted with caution given the smaller sample size. While there is still room for improvement, these trends indicate growing attention to oversight and safeguarding.

Levy-payers vs levy-refusers

Overall compliance levels for levy-paying charities were higher than for levy-refusing charities across almost all categories. The biggest differences were in reporting on voluntary regulations and schemes, and on how third-party fundraising is monitored. Although the sample of levy-refusing charities was relatively small (34 charities with an income over £1 million), the findings suggest that these organisations still need to significantly improve their reporting in order to comply with the Act.

Clarity and detail

The proportion of levy-paying charities providing detailed information fell notably for reporting on voluntary regulations and schemes, monitoring of third-party fundraising and complaints processes. Levels of detail for fundraising approaches and for protecting people in vulnerable circumstances remained broadly consistent. These changes may reflect differences in the sample, as well as the inherently subjective nature of assessing clarity and detail. The Act does not require charities to meet clarity and detail thresholds; however, clear explanations of fundraising activity remain important for transparency, accountability, and maintaining public trust.

Levy-paying charities

Of the 202 levy-paying charities reviewed, none reported on requirement C, and for 52 charities requirement D was not applicable. Of the remaining 150 charities, 56% provided statements covering all applicable requirements (A, B, D, E and F) an increase from 33% in 2022. However, 11% (17 of 150) of charities in the 2025 sample reported on none, compared with 9% (13 of 144) in 2022.

Clarity and detail

As stated in previous reports, we also assessed the level of clarity and detail provided by charities when reporting on the required sections of the Act. In depth comparisons with previous reports, levels of clarity and detail with previous reports would not be meaningful. The category is inherently subjective, as the scores were taken from two different samples of charities in 2022 and 2025. Nonetheless, the scores still offer some insight into how organisations communicate their fundraising activities.

For levy-paying charities, the clearest areas of reporting related to their fundraising approaches (76%), participation in voluntary regulations and schemes (69%), and the number of fundraising-related complaints received (69%). Clarity was notably lower in statements describing how charities monitor fundraising activities undertaken on their behalf (43%) and the measures they take to protect vulnerable people and the wider public during fundraising (47%). Our analysis also found that 64% of charities presented all required statements within a single section, making it easier for readers to locate the relevant information. This represents a decrease from 82% in 2022.

The extent of detail varied, highlighting the importance of accessible and meaningful reporting for public accountability. It is important that statements are written accessibly in a clear way with the relevant information included. By giving more detail, charities can build donor trust and generate continued support. Our guidance provides more information on points to consider when writing fundraising statements.

Levy-refusing charities

We reviewed the reports of 34 levy-refusing charities, all of whom refused the levy and were above the £1 million SORP reporting threshold. These charities scored comparatively lower than levy-paying charities, except for category (C) for each of the reporting requirements.

Of the levy-refusers, 18 did not use third-party fundraising and therefore were not required to report on requirement D. Among the remaining 16 charities, 36% reported on all the requirements they were eligible for, up from 13% in 2022, while 24% reported on none, an improvement from 32% in 2022.

Although most charities still included a statement setting out their fundraising approach and the number of complaints they had received in the past year, few stated whether they were subject to voluntary regulation.

Only 2 out of 34 charities stated that they did not follow voluntary regulation. However, we consider that all 34 charities should have included a statement to this effect. Charities with an annual fundraising expenditure of above £100,000 are required to register with the Fundraising Regulator and pay the voluntary annual levy. All 34 charities exceeded this threshold but did not pay the levy. As a result, they were not registered with the Fundraising Regulator and failed to adhere to regulation.

The lack of reporting by these charities may be partly explained by the fact that they are lower down the levy fee scale. These charities tend to spend less on fundraising and usually also have a lower income. They may be less aware of the reporting requirements or have fewer resources for reporting than larger charities However, their scores were still much lower than those of the levy-paying charities in the same levy fee bands.

Clarity and detail

As with levy-paying charities, we assessed the level of clarity and detail provided by levy-refusing charities when reporting on the required sections of the Act. The assessment of detail can vary and the scores were taken from two different samples of charities in 2022 and 2025. Comparisons with previous reports would not be relevant for clarity and detail; nonetheless, the scores offer some insight into how organisations communicate their fundraising activities.

For levy-refusing charities, the clearest areas of reporting related to their fundraising approaches (65%) and the number of fundraising-related complaints received (56%). Clarity was lower in the remaining categories: participation in voluntary regulations and schemes (35%), statements describing how charities monitor fundraising activities undertaken on their behalf (7%) and the measures they take to protect vulnerable people and the wider public during fundraising (32%).

Our analysis also found that 53% of charities presented all required statements within a single section, making it easier for readers to locate the relevant information. This represents a slight decrease from 54% in 2022.

Next steps

We will share the findings and recommendations of this research with CCEW and work with them to promote good governance. We will also share the research with the Institute of Chartered Accountants in England and Wales (ICEAW), as some information may be relevant to charity audits.

We have previously published guidance aimed at helping charities to comply with the Act but, we recognise that some charities still have several areas for improvement. We will update the guidance in 2026 to reflect the new SORP thresholds.

Additionally, we wrote to 17 levy-paying charities and 8 levy-refusing charities, who, according to our analysis, did not report on any of the Act’s requirements. We explained that we believe they have failed to comply with the Act and must improve the quality of their reporting, including adding the required fundraising statements to all future relevant annual reports.